Newsletter – August 2022

Click here to view and download the newsletter in its original format.

Welcome to our August newsletter – I hope you got to enjoy the recent heatwave, it really made up for the previous 8 weeks of lack of sunshine. As we face into the autumn, here’s some items for you to consider.

Help Speed Up Getting Paid

We have recently come across a payments app called Crezco (www.crezco.com), which you can integrate into many accounting packages, including XERO, that allows your customers pay you seamlessly with a few clicks. It is an open banking payments solution designed for online invoice payments. Crezco initiates bank-to-bank transfers seamlessly and securely for users. Funds are transferred immediately without fees and payments reconcile with your XERO package instantly.

Corporation Tax Return Deadline

Companies with a year-end of 31st December must file and pay their corporation tax by 19th September next. Remember that if you purchased an electric car in 2021, you may be able to avail of a full €24,000 credit against corporation tax, so make sure you contact us to let us know this if you haven’t done so already. Indeed, some clients bought more than 1 electric car, and therefore have a significant tax break in this regard.

Need a Loan?

If you are in need of some working capital or wish to purchase a property etc, there are new lenders entering the market every month it seems. An old reliable, but surprising one that a client recently availed of was the Credit Union.

The Credit Union I hear you ask? For business? Yes, a number of Credit Unions (only 1 in Dublin – Savvi) participated in the SBCI Brexit Impact Loan Scheme (BILS). This was offered in conjunction with the Dept of Enterprise Trade and Employment and the European Investment Bank.

Having assisted our client in securing this loan, we found the application process was less onerous than we had experienced with a main street bank whom we had previously applied through. If this seems of interest, we suggest you contact Savvi Credit Union at conall.ocallaghan@savvi.ie or 01 6325100. The scheme runs until December 2022, or when the scheme is fully subscribed.

INCOME TAX RETURNS – Please send us your data as soon as you can, the deadline is fast approaching.

Keep Your Returns Up to Date to Continue to Avail of Debt Warehousing

July and August saw a marked increase in the interventions by Revenue with clients who are not filing and/or paying current tax liabilities on time, leading to the withdrawal of the debt warehousing facility. This has caused the client very difficult cash flow issues and undermined their ability to continue to trade.

Changes in Electric Vehicle Grants – €600

July saw the announcement of a number of grants primarily in relation to electric car chargers, to encourage more chargers to be installed in previously non-qualifying locations. From September, the Home Charger Grant Scheme will only support smart chargers registered on Tripe E.

Grants are now available to Management Companies, commercial and private landlords, sports clubs, people living in apartments and multi dwelling units, and for people who don’t own an Electric vehicle e.g. for visitor use or rented accommodation.

Bye-Bye to Executive Pensions and One-Person Schemes for New Business Owners

Business owners have been frozen out of the pensions market after the regulator threatened to prosecute people using existing pension products. The five insurers in the state selling single-member pension schemes – and all the boutique SSAP providers – all suspended opening any new plans on pending clarification from government. That is not likely until the budget in September and any measures announced there will not take effect until the Finance Act is passed into law close to the end of the year. The action means thousands of business owners will not be able to make any significant effort to save for their retirements – at least for the next six months.

Given the absence of an effective alternative savings vehicle and the fact that older schemes have a number of years yet in which to make arrangements, insurers had understood the regulator would not be taking a hard line on the issue – at least until an alternative product was approved.

Anyone who had already set up such a scheme since late April 2021, who are nominally also affected by the new rules, could continue to use them for now. We strongly recommend you contact your financial adviser to get professional advice.

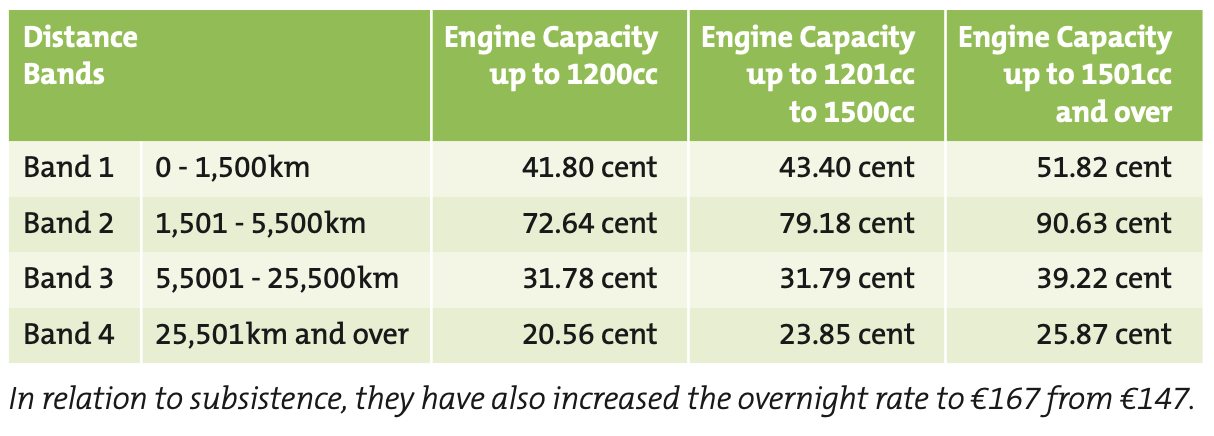

Good News After 5 Years

The Revenue have finally acknowledged that motoring costs have increased significantly over the last number of years. This has resulted in increased rates per kilometer from 1st September. So here are the new rates: