Newsletter – September 2021

Click here to view and download the newsletter in its original format.

Welcome to our September newsletter, heralding the start of Autumn, shorter days, return to school, return to traffic and for many a return to an office for the first time in 20 months!

Personal Income Tax Return Deadline

The deadline to file your income tax returns is 31st October for paper returns, and 17th November for electronic returns. Here’s a quick checklist of typical things you can claim tax relief for:

- Medical and dental expenses – you need a MED 2 form from your dentist

- Nursing home expenses – you may have paid them for a parent?

- Payments made to a carer for yourself or a parent

- IVF and fertility treatment

- College fees over €3,000

- Permanent health insurance premiums

- Home office expenses such as ESB, GAS and broadband

- Hotel and restaurant expenditure from 1st October – 31st December 2020

- Losses incurred on disposal of an asset – investment property, shares, funds, etc.

If you have failed to claim any of the above items as far back as 2017, it’s not too late we can still claim for them now.

It’s Pension Time

With the upcoming income tax deadline, this is the season when sole traders, or any individual with an income tax bill typically makes a lump sum contribution to their pension.

Remember, you may make a pension contribution up to 14th November 2021, and you may still use that to reduce your 2020 income tax bill in most circumstances. If You would like to make a pension contribution, but you have no cash – its all tied up in debtors or stock, most of the banks offer a very attractive pension loan facility of under 4%, that you may then repay over 10 months.

Please contact our office if you wish to consider the benefits of making a pension contribution, and we can work the figures out for you and then refer you on to a pension advisor if you wish.

Personal Finance Corner

Many of our clients get confused with the different types of insurance that is out there. Here is an explanation of the main ones and the tax treatment of each.

Health Insurance

This is the likes of VHI, Irish Life & LAYA, etc. This covers you for consultant’s fees, hospital visits and operations, etc. If you pay the premium directly personally, the provider automatically deducts 20% for tax relief. So, if your premium is €1,000, you only pay €800. In this way you receive the tax relief. If your employer pays the premium directly, they must pay the gross €1,000, and you must then apply for a refund of the €200. Many clients do not do this. Also, if your employer pays the premium, they must apply Benefit in Kind.

Critical/Serious Illness

This is an insurance policy which pays out if you are unfortunate enough to contract one of the listed serious illnesses on the plan, such as cancer, heart attack or stroke. After a successful claim, after your diagnosis, the insurance company will pay out a lump sum to you tax free. The amount paid out will depend on the level of cover you choose at the outset. There is no tax relief on this policy as the payout is tax free. If the company pays the premium, it is subject to Benefit in Kind.

Permanent Health Insurance (Income Protection)

So, lets imagine after your serious illness, you got the lump sum, but now you are out of hospital, but you can’t return to work. This policy is designed to replace your income should you get ill and not be able to work. Most policies have a 13-week deferred period before the claim will commence. You can now get cover after a deferred period of 4 weeks or 8 weeks. You can also select a deferred period of 26 or 52 weeks. So, if you got a stroke, and could not work anymore, after your selected deferred period, the insurance company will pay you up to 75% of your salary (less any state benefits) until you can return to work or the end of the plan which could be age 65. Some plans will now cover you to age 70. Tax relief may be claimed on this premium by the individual, OR an employer may pay it directly without charging any benefit in kind. The reason tax relief is given is that the payment you receive when claiming is subject to tax.

The Mortgage Market

Is it now time to consider switching your mortgage?

Property prices nationwide are up on average 13% in the last 12 months* which gives hundreds of thousands of existing mortgage holders a fantastic opportunity to save themselves huge amounts in interest repayments just by taking advantage of the lower rates now available to them.

One of the main issues affecting all residential property owners is the interest rate they pay on their mortgage. Now more than ever you have to ask yourself, are you paying too much?

The Banks are actively lending again and have dropped their rates considerably over the past year and a half. This presents an opportunity for homeowners, who may feel they are being ripped off on their interest rate, to potentially reduce the amount of interest they will pay over the term.

A lot of people switch their electricity and gas providers on an annual basis to receive a discount but rarely think of switching their mortgage, which in most households is the biggest expense.

The amount you can save depends on the size of your loan, the value of the home for which you are borrowing, and how expensive your current lender is. A lot of people may not be in a position to switch, e.g. if you are currently in negative equity, have a bad credit rating or your circumstances don’t meet the banks criteria (not enough income, excess loans, etc.). Also, if you are on a tracker rate it’s extremely unlikely switching lender would make sense. However for many others the opportunity to switch should be too good to ignore.

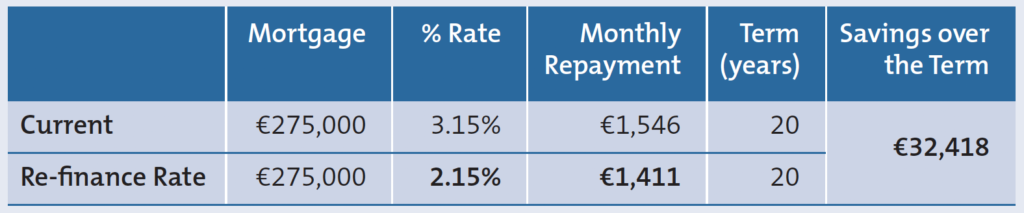

Here is an example of how much you can save on a mortgage of €275,000 over 20 years by simply getting a better rate: